News

Daylight Savings Time Comes to an End

Before bedtime, don't forget to turn your clocks back 1 hour on Saturday, November 2nd!

Happy Labor Day!

Enjoy a restful, relaxing and FUN holiday weekend!

Spring has arrived!

...and so has the real estate market! If you're looking to buy or sell, I can help!

Veteran's Day 2023

Thank you for your service to our country!

🍁 5 Interior Color Trends for Fall 🍂

Fall is almost here and if your home needs a refresh, there’s no better way to do it than by ...

Go to news

Go to news

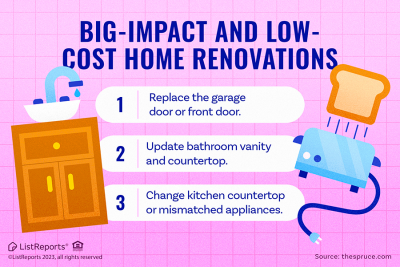

Home Security Tips!

Your home is a place you want to feel safe and secure from the outside world. Implementing simple ...

Go to news

Go to news

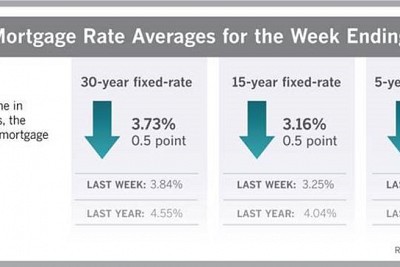

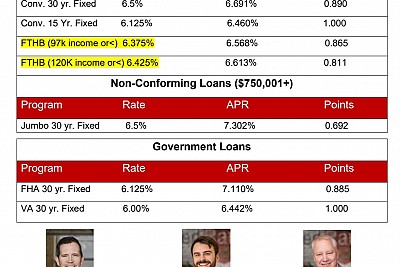

Markets in a Minute

Here's your Weekly Markets in a Minute - brought to you by Bell Banks! Have a great wkend!

Go to news

Go to news

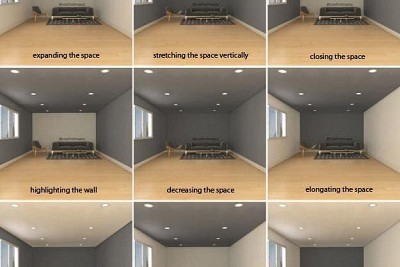

Design Trends that Homeowners Will Absolutely Love

You own a home, we own homes. The one thing that we can say for certain about being a homeowner is ...

Download document

Download document

Give to the MAX Day 2021!!

Give to the Max is a statewide outpouring of support for thousands of nonprofits and schools across ...

Go to news

Go to news

Finding your Dream Home!

Let me help you find that perfect home! It's what I do!

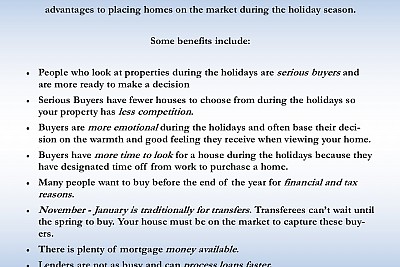

It's That Time of Year Again!

IT'S A GOOD TIME TO CHANGE OUT THE BATTERIES IN YOUR THERMOSTAT AND SMOKE DETECTORS TOO!

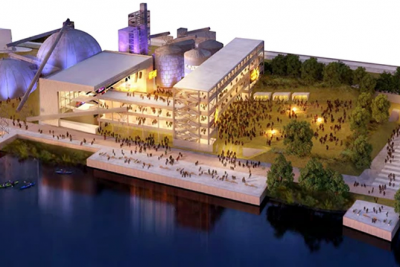

Everything You Need to Know About Minneapolis' Upper Harbor Terminal Project — And What Happens Next

The massive plan to turn 48 acres of riverfront land into housing, businesses and an outdoor ...

Go to news

Go to news

.png)

.png)

.png)